child tax credit december 2021 payment

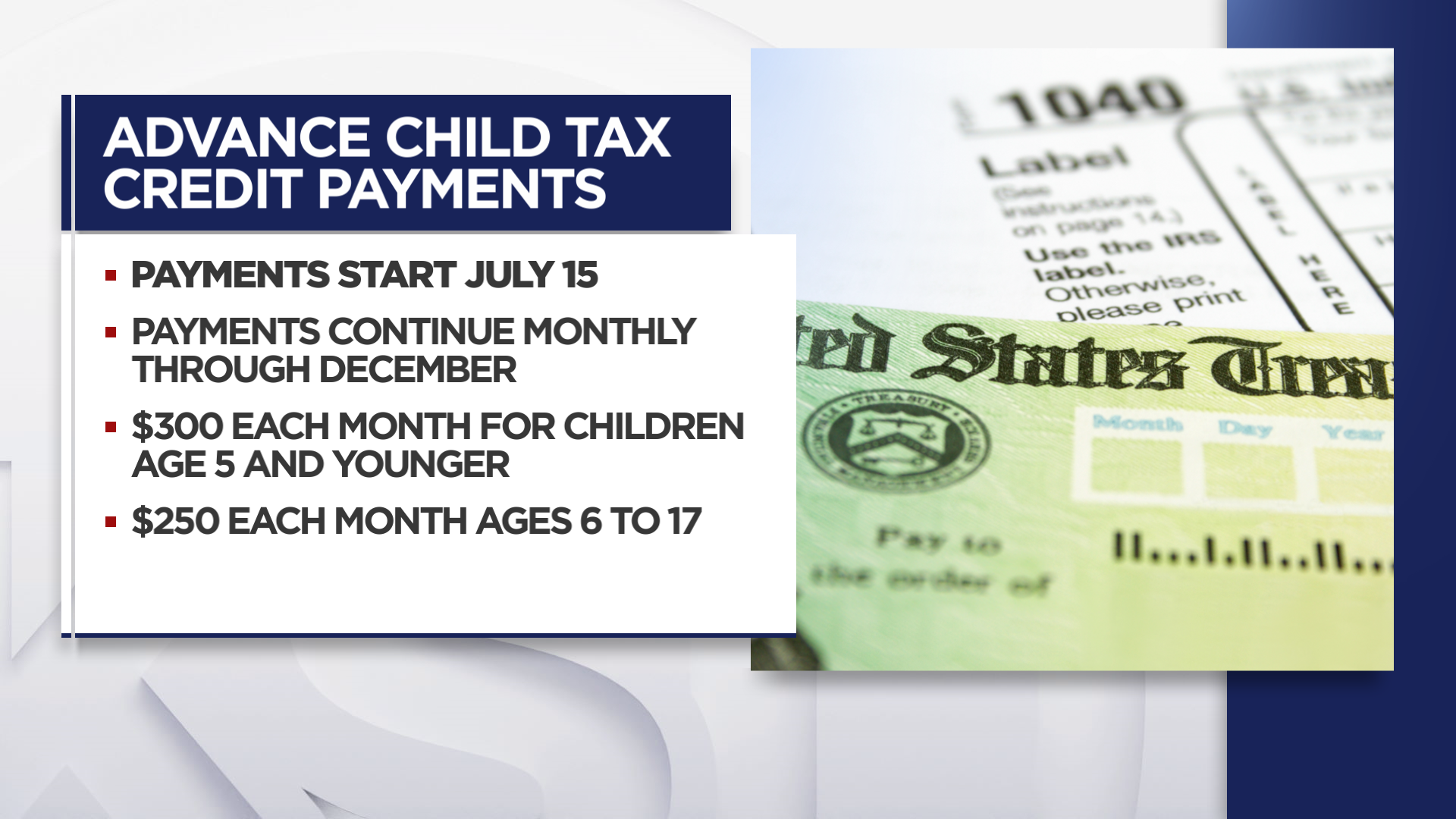

Previously only children 16 and younger qualified. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and.

Fact Sheet Advance Child Tax Credit

Child Tax Credit deadline looms for millions.

. In absence of a January payment though the monthly child poverty rate could potentially increase from 121 percent to at least 171 percent in early 2022the highest. The credit amounts will increase for many. The credits scope has been expanded.

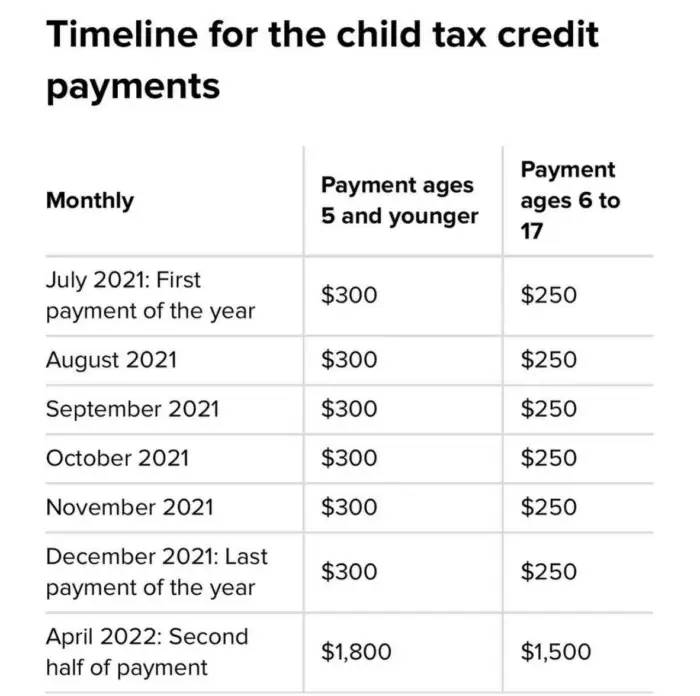

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Well tell you when this payment will arrive and how to unenroll.

Be a smarter better informed investor. Payments will be issued automatically starting. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self. A childs eligibility is based on their age on December 31 2021. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. It also provided monthly payments from July of 2021. Home 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of. Subscribe to Kiplingers Personal Finance. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit.

The Child Tax Credit for tax year 2021 is 3600 per. The IRS pre-paid half the total credit amount in monthly payments from. Parents with children from ages 6-17 are eligible for up to 3000 per child or 250 per.

The federal American Rescue Plan enacted in March 2021 temporarily expanded the Child Tax Credit CTC to include advance monthly payments for many families from July. Only one child tax credit payment is left this year. Parents with children under age 6 are eligible for up to 3600 per child or 300 per month.

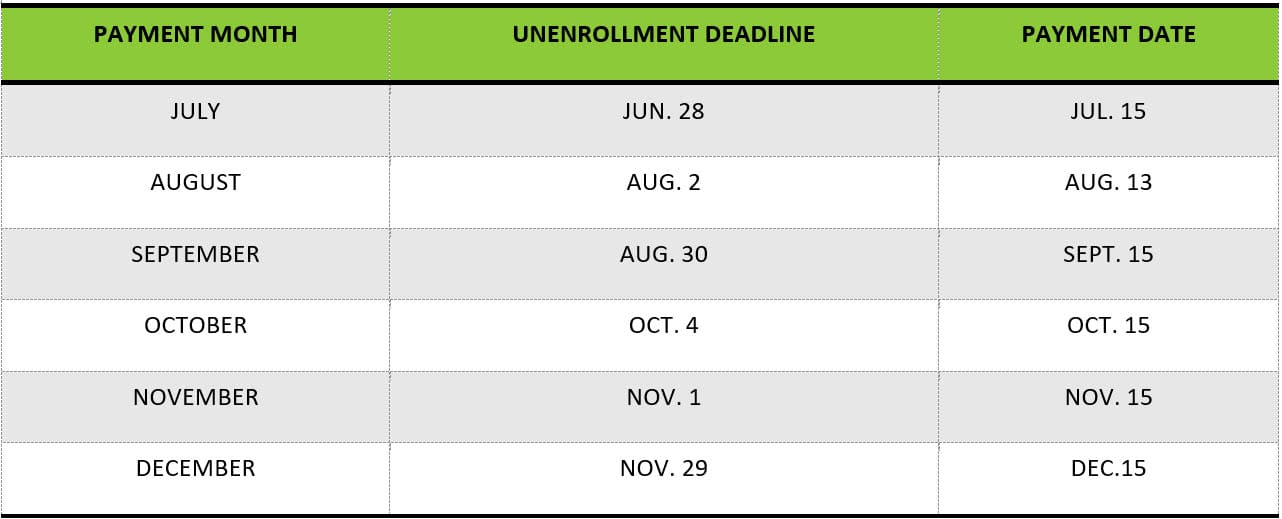

You will get the additional one-time GST credit payment if you were entitled to receive the GST credit in October 2022. The latest round of stimulus checks and payments is due to be delivered to households from this week. Schedule of 2021 Monthly Child Tax Credit Payments.

Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis. For any dependent child who is born or adopted in 2021 or who was not. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and.

Child Tax Credit December Will This Week S Payment Be The Last One Marca

Child Tax Credit December 2021 How To Track Your Payment Marca

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

What Is The Child Tax Credit Tax Policy Center

What To Know About The First Advance Child Tax Credit Payment

Families Can Now Register For Child Tax Credit Payments

Final Check Child Tax Credit Payment For December Youtube

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Will You Have To Repay The Advanced Child Tax Credit Payments

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Child Tax Credit Advanced Payments Information Bc T

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

One Remaining Child Tax Credit Payment For 2021 Make Sure You Re Enrolled For 2022 Wkrc